Cape Cod Mortgage Payments

Ok, you’ve made it this far and haven’t closed your browser, so that is a good thing.

Please keep in mind, this top secret formula will by no means be exact.

Mortgage Payment Formula:

For every $1000 you borrower, your TOTAL monthly mortgage payment will be $6 – $8, depending on your rate and program.

So, if you purchase a home for $250,000 with a $50,000 down payment – borrowing a total of $200,000, then a good estimated total monthly PITI payment would be roughly $1600.

But don’t forget to add your homeowners association dues to that monthly payment.

What If I Pay Taxes and Insurance Separately?

Well now we’re at the easy part. If you elect to pay taxes separate from your mortgage, the cheat sheet is reduced from $8 per $1000 down to $6 per $1000.

So there you have it. $8 for every $1000 borrowed.

Again, please keep in mind that this is not going to give you an EXACT payment. You may be purchasing a property with higher real estate taxes or your insurance premiums may be higher than average depending on the state you live in.

Mortgage Payment Basics

Just in case your first mortgage payment comes due before you get your first payment coupon in the mail, there should actually be a temporary payment coupon included with your closing documents.

Your mortgage payment is generally due at the beginning of the month, and most lenders start assessing late fees on the 15th. It is extremely important to remain under 30 days late on a mortgage payment, especially within the first 8-12 months of closing on a new loan.

When you receive your first mortgage bill, there will be a few numbers that add up to your total payment:

Principal –

This is the portion that goes towards paying down your balance. An Amortization Schedule will break down the exact amount of each payment that is being applied to the principal and interest.

Interest –

The interest payment is essentially the amount you’re paying the bank over time to borrow the principal balance.

Depending on which loan program, interest rate and closing cost scenario you chose, the amount of interest due every month may vary.

Taxes –

Real Estate Taxes can either be included (Impounded) in your monthly payment (PITI), or paid by the homeowner separately.

Certain government loan programs or high Loan-to-Value (LTV) mortgages require that taxes and insurance be included with the total mortgage payment.

Either way, it’s important to make sure you ask your loan officer and/or closing agent during the final loan docs signing to clearly explain what’s included in your monthly mortgage payment.

Insurance –

This is your hazard insurance (Fire), which protects your home and belongings.

While there are many ways to save money on your property insurance, it’s important to know and trust your insurance agent so that you can be fully aware of what’s covered in your policy.

Some homeowners shopping strictly on price may unknowingly leave valuable personal items without protection just to save an extra $15-$19 a month.

Mortgage Insurance –

This can come in a few different forms, depending on whether you have an FHA loan, VA, Conventional, Jumbo…

Mortgage insurance is in addition to hazard insurance, and completely unrelated. A lender will require a borrower to pay mortgage insurance on a property with a Loan-to-Value greater than 80%. The main purpose of mortgage insurance is to protect from foreclosure losses if the borrower fails to meet the monthly payment obligations.

FHA has mandatory Mortgage Insurance, but in a different form.

VA loans have a separate Funding Fee to help protect their interests.

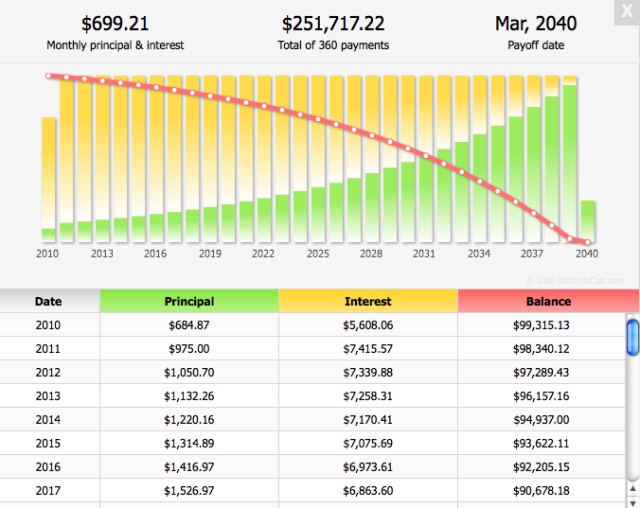

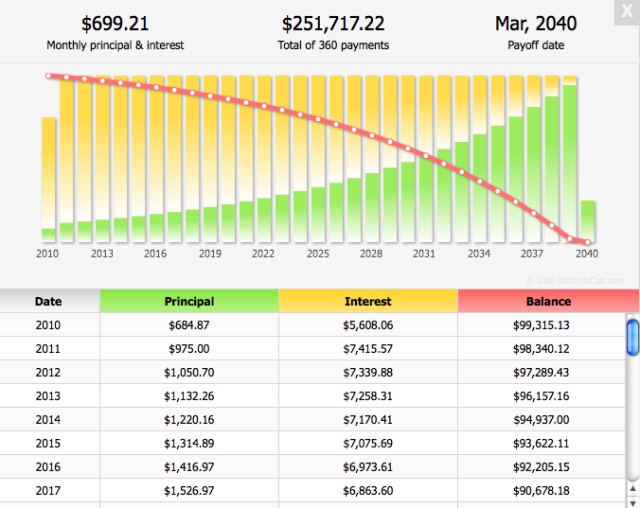

Amortization Schedule

By committing to a mortgage loan, the borrower is entering into a financial agreement with a lender to pay back the mortgage money, with interest, over a set period of time.

The borrower’s monthly mortgage payment may change over time depending on the type of loan program, however, we’re going to address the typical 30 year fixed Principal and Interest loan program for the sake of breaking down the individual payment components for this particular article about an amortization schedule.

On each payment that is made, a certain amount of interest is taken out to pay the lender back for the opportunity to borrow the money, and the remaining balance is applied to the principal balance.

It’s common to hear industry professionals and homeowners talk about a mortgage payment being front-loaded with interest, especially if they’re referencing an amortization chart to show the numbers. Since there is more interest being paid at the beginning of a mortgage payment term the amount of money applied to interest decreases over time, while the money applied to the principal increases.

We can better understand mortgage payments by looking at a loan amortization chart, which shows the specific payments associated with a loan.

The details will include the interest and principal component of each periodic payment.

For example, let’s look at a scenario where you borrowed a $100,000 loan at 7.5% interest rate, fixed for 30 year term. To ensure full repayment of principal by the end of the 30 years, your payment would need to be $699.21 per month. In the first month, you owe $100,000, which means the interest would be calculated on the full loan amount. To calculate this, we start with $100,000 and multiply it by 7.5% interest rate. This will give you $7,500 of annual interest. However, we only need a monthly amount. So we divide by 12 months to find that the interest equals $625. Now remember, you are paying $699.21. If you only owe interest of $625, then the remainder of the payment, $74.21, will go towards the principal. Thus, your new outstanding balance is now $99,925.79.

In month #2, you make the same payment of $699.21. However, this time, you now owe $99,925.79. Therefore, you will only pay interest on $99,925.79. When running through the calculator in the same process detailed above, you will find that your interest component is $624.54. (It is decreasing!) The remaining $74.68 will be applied towards principal. (This amount is increasing!)

Each month, the same simple mathematic calculation will be made. Because the payments are remaining the same, each month the interest will continue to be reduced and the remainder going towards principal will continue to increase.

An amortization chart runs chronologically through your series of payments until you get to the final payment. The chart can also be a useful tool to determine interest paid to date, principal paid to date, or remaining principal.

Another frequent use of amortization charts is to determine how extra payments toward principal can affect and accelerate the month of final payment of the loan, as well as reduce your total interest payments.

Mortgage Payments in Cape Cod

Mortgage Payments in Cape Cod